MSCI Australia Select High Dividend Yield Index. Most Recent Full Year Dividend Current Stocks Price For instance RM 1 RM 20 x 100 5.

Reits Dividend Yields Of 5 9 From 2022 Onwards Attractive Earnings Recovery Seen As Economy Reopens Uob Kayhian Research The Edge Markets

Is Igb Reit The Best Reit In Malaysia

The Complete Guide To Reits In Malaysia Dividend Magic

Monthly Dividend Paying Stocks List.

Igb reit dividend. SPDR SP Global Dividend Fund SPDR SP Global Dividend Aristocrats Fund AUS 05 WXHG State Street. Index sector commodity etc so they are a great way to get exposure to an entire component of the market through one share transaction. It remains committed to bringing about long-term value for its stakeholders it said.

This is a list of notable Canadian exchange-traded funds or ETFsThis is not an exhaustive list. The information contained on this website is for general information purposes only. CGS-CIMB RESEARCH OCT 27.

Download CSV with Market Caps. Real Estate Investment Trust REIT. We believe IGB REITs flagship malls strong neighbourhood appeal is well-positioned to benefit from the turnaround in retail mall sentiment and a recovery in retail sales which is its key medium-term potential share price catalyst.

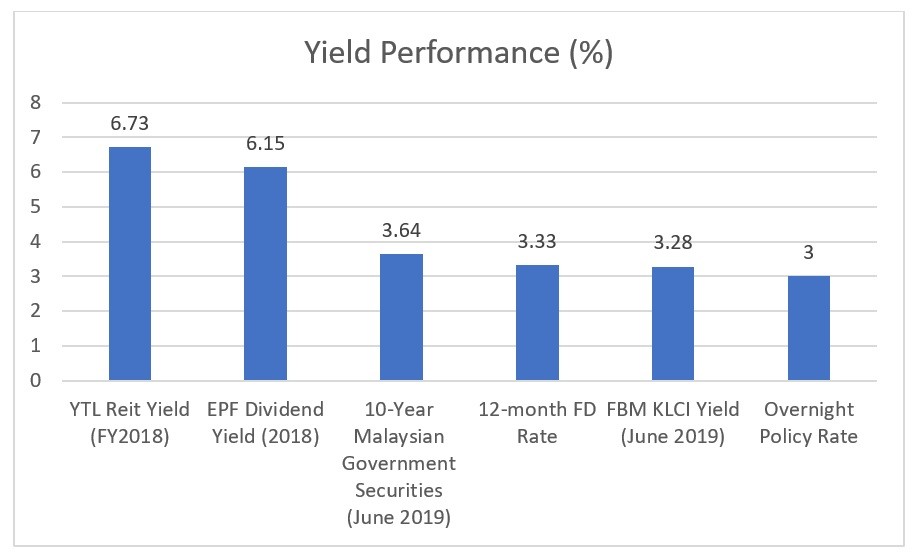

We view IGB REIT as a recovery play with compelling double-digit earnings growth and dividend yields of more than 45 for FY22F and beyond the backdrop of the current low interest rate environment. FTSE Australia 300 Choice Index. This is usually done to compute Trailing Dividend Yield.

09 Mar 2012 0900 PM Post 1. We deem the performance as broadly in line as we project robust q-o-q growth in earnings in 4QFY21F supported by. IGB REITs 9MFY21 core net profit of RM1266m -232 YoY was below ours and consensus expectations.

Dividend Yield 2020 418. Below is our full monthly dividend paying stocks list as a subset of our Dividend Channel coverage universe. Dec 2011 Male MYS.

For 3QFY21 IGB REIT declared an income distribution of 118 sen a unit comprising 116 sen and 002 sen taxable and non-taxable portions respectively. A dividend reinvestment plan DRP is a program some companies offer that allows investors to choose between receiving a cash dividend or automatically reinvesting their dividend payment back into the company for additional shares. Vanguard Australian Shares High Yield ETF.

The general formula for dividend yield. The public subscription of. IGB REit was listed at an offer price of RM125 where 469 million units were offered to Malaysian and overseas institutional investors.

Explanation of how they work. Myetf msci malaysia islamic dividend net asset value indicative optimum portfolio value 11 19 nov 2021 19 nov 2021 myetf dow jones islamic market malaysia titans 25 net asset value indicative optimum portfolio value 12 19 nov 2021 19 nov 2021 tradeplus msci asia ex japan reits tracker. SPDR SP Emerging Markets Fund SPDR SP Emerging Markets Large Mid Cap Index AUS 064 WDIV State Street.

ASX Listed Companies 1 June 2020 Excel CSV. Many companies offer a small discount to the current share price to encourage participation in their DRP. The negative deviation was due to higher-than-expected rental assistance provided.

AmInvest Research - 27 Oct 2021. Completed acquisition of Pangkor Laut Resort Tanjong Jara Resort Cameron Highlands Resort The Ritz-Carlton Kuala Lumpur Vistana Kuala Lumpur Vistana Kuantan and Vistana Penang as well as the remainder of The Residences at The Ritz-Carlton Kuala Lumpur not already. Dividend of 118 sen per unit was declared.

View this post on Instagram. We also have several sub-lists you can explore such as monthly dividend growth stocks monthly dividend paying real estate. If one has been following Axisreit over the long term the reit has been using this way to expand its portfolio and EPSdividend is improving from its initial IPO so does share price from RM1xx prior before share split 11 to now what it is today.

IGB REIT is determined to stay resilient throughout the Covid-19 pandemic and the subsequent endemic phase. IGB REITs 9MFY21 results made up 70 of our and consensus full-year forecasts. If a reit intends to do private placement means they may be eyeing newer acquisition.

SPDR MSCI Australia Select High Dividend Yield Fund SYI. Mid Valley and Sunway Pyramid they belong to IGB REIT and Sunway REIT respectively and have been solid performers in my Freedom Fund. Its DPU shown in table above is an annualised forecast for the period between April and December 2021.

Vanguard Ethically Conscious Australian Shares ETF. Most ETFs track a benchmark of some sort eg. IGB REIT closed one sen or 06 higher at RM168 translating into a.

Trailing dividend yield represents dividend percentage paid over a prior period typically one year. MSCI Australian Select High Dividend Yield Index AUS 035 SPY State Street. A post shared by DIVIDEND MAGIC dividendmagic.

1 easing rental support and 2 strong recovery in car park income benefitting from the full economic reopening under the National Recovery Plan NRP Phase. Complete list of Exchange Traded Funds ETFs trading on the ASX. At 1048am on Wednesday Oct 27 IGB REITs unit price was unchanged at RM168 which values the group at about RM6 billion based on IGB REITs 357 billion issued units.

SPDR SP 500 ETF Trust SP 500 US 009 WEMG State Street. ETFs are managed funds that trade on the ASX just like ordinary shares. Download Click any company code in the table to access the share price chart announcements registry details and dividend history.

CGS-CIMB Research retained an Add rating for IGB REIT supported by FY21 to FY23 dividend yields of 37 per cent to 53 per cent. IGB Commercial REIT was listed in September 2021 and has yet to release its full-year results.

How To Invest In Reit Malaysia Definitive Guide 2021 Kclau Com

Igb Reit Seen To Have Lower Non Renewal Risk Edgeprop My

M Reits Still Favoured Despite Expected Lower Rents The Edge Markets

Dividend Income Update 2016 Dividend Magic

Igb Real Estate Investment Trust Company Profile Stock Performance Earnings Pitchbook

Six Dividend Stocks That May Shine When Interest Rates Drop The Edge Markets

Reits As A Less Stressful Option

Introduction Reits And Why Invest In Them No Money Lah