Real Property Gains Tax RPGT is a form of Capital Gains Tax that homeowners and businesses have to pay when disposing of their property in Malaysia. It also saves a lot of time and very easy to complete it online rather than conventional methods by manually filling up the form because all the calculation is automatic.

Prs Tax Relief Private Pension Administrator

Get 50 Tax Deduction From Property Rental Income Free Malaysia Today Fmt

2019 Malaysia Personal Income Tax Exemptions Comparehero

603 2162 8989 Fax.

Tax exemption malaysia. Tax Rates on Income Other Than Personal Service Income Under Chapter 3 Internal Revenue Code and Income Tax Treaties Rev. This means that if one day you decide to sell your house you have to pay taxes on the profit gains if you have any. EzHASil e-Filing is a most convenient way to submit Income Tax Return Form ITRF.

A Tax Clearance certificate is a document which the South African Revenue Services SARS issues with regards to the persons tax affairs. In a move to clarify the nature character and tax treatment of corporations under Section 30 of the Tax Code the Commissioner of Internal Revenue CIR issued Revenue Memorandum Order RMO No. These days many companies have found ways to streamline the exemption certificate management process by shifting the responsibility to.

There are different types of tax incentives offered in Malaysia in the form of tax exemptions allowances related to capital expenditure and enhanced tax deductions. Feb 2019 PDF This table lists the income tax and withholding rates on income other than for personal service income including rates for interest dividends royalties pensions and annuities and social security payments. Exemption from the Sales Tax under clause 99 Table B Sales Tax Order Exemption 1980 is a facility provided for the benefit of local factory operators that manufactures goods that are exempted from the Sales Tax which are meant for export and also on control items under the Ration Control Act 1961 which is bound under the price control to get taxed raw materials including packaging.

In another announcement related to the topic of automotives Tengku Zafrul also announced that the 100 sales tax exemption for CKD vehicles will be extended until 30 June 2022. A tax treaty is a bilateral two-party agreement made by two countries to resolve issues involving double taxation of passive and active income of each of their respective citizens. Tax exemptions either reduce or entirely eliminate your obligation to pay tax.

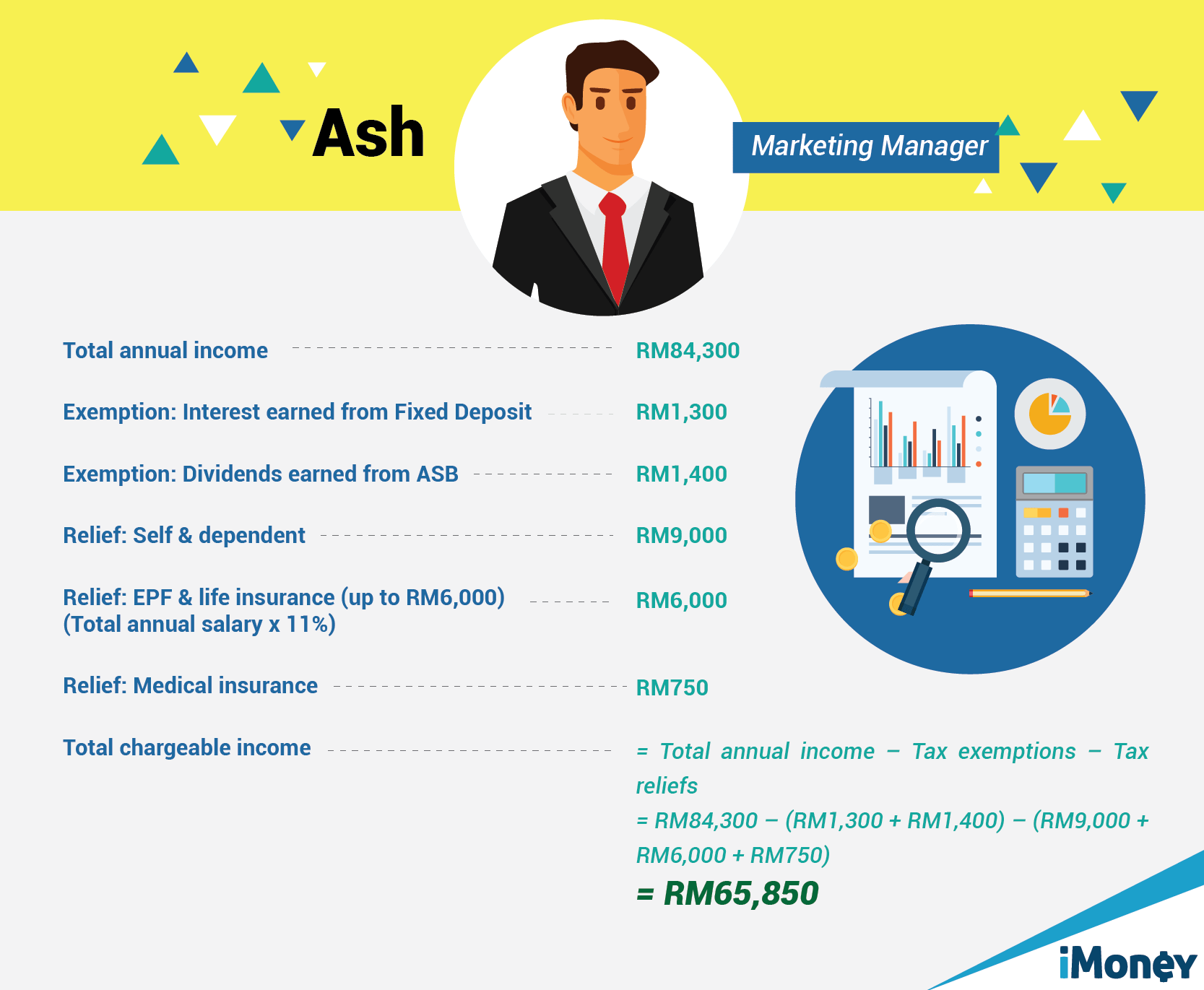

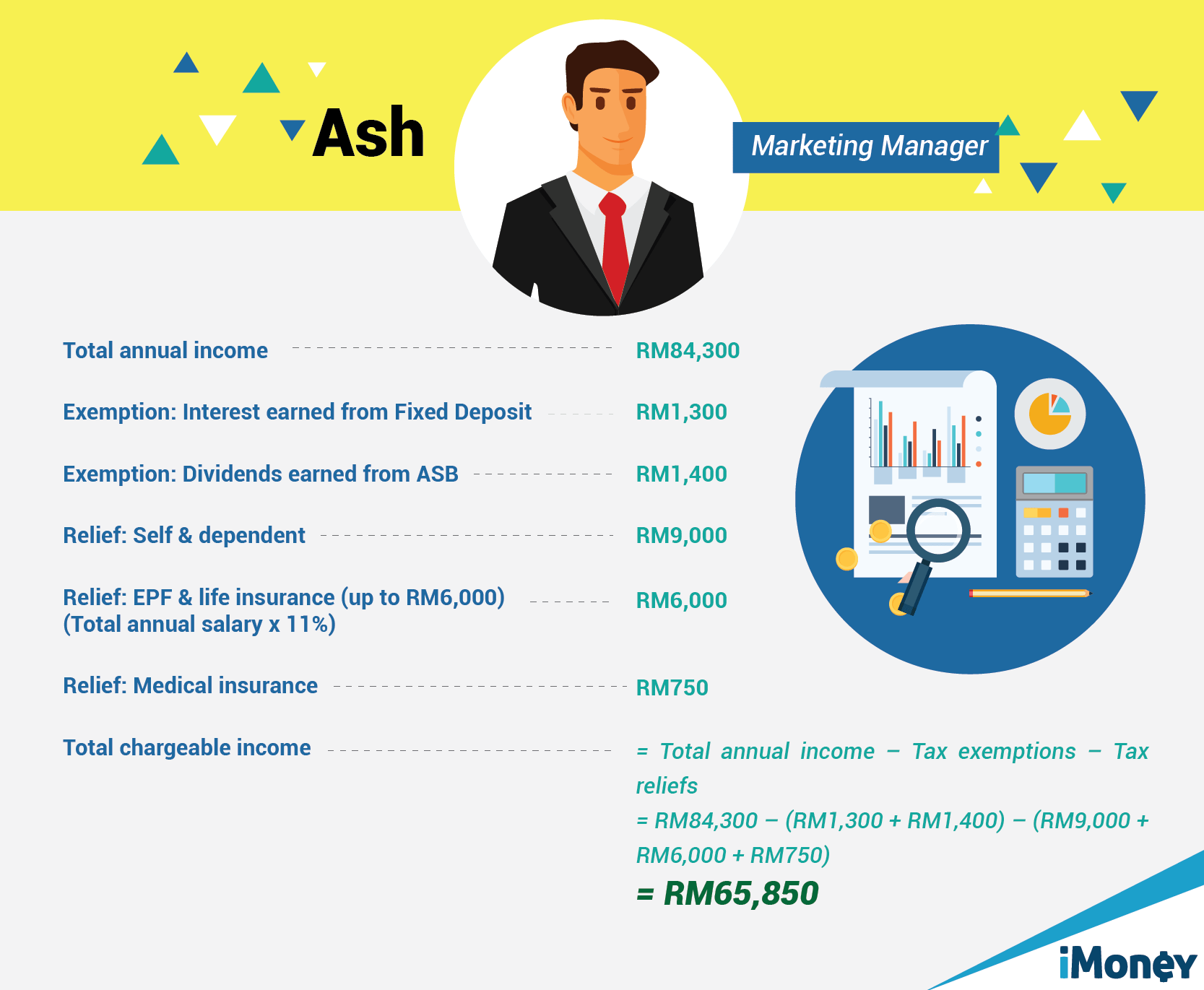

For income tax filed in Malaysia we are entitled to certain tax exemptions that can reduce our overall chargeable income. Meanwhile the finance minister also said that the increase in the threshold price of the crude palm oil CPO windfall profit tax WPT structure for local plantation companies is expected to benefit. Chartered Tax Institute of Malaysia 225750-T B-13-1 Block B Unit 1-5 13th Floor Megan Avenue II 12 Jalan Yap Kwan Seng 50450 Kuala Lumpur Malaysia Tel.

Tax teams were typically responsible for collecting and maintaining exemption certificates back in the day ie before the internet and automated solutions. When it comes to the season of income tax in Malaysia thats when people tend to leave things till the last minute are you one of them and then make careless mistakes out of panic. In Budget 2022 announced on Oct 29 it was proposed that income tax be imposed on residents in Malaysia with income derived from foreign sources and received in Malaysia from Jan 1 2022.

It is the activities of a non-stock nonprofit corporation that entitle it to a tax exemption. KUALA LUMPUR Oct 30 The extension for tourism tax exemption until December 31 through the presentation of Budget 2022 in the Dewan Rakyat yesterday will help revive the tourism industry in the three Federal Territories. Whether youre a property investor or an owner just simply looking to sell your current home to purchase your dream home its important to be aware of all costs associated with a real estate transaction.

The Exemption Order would be relevant and applicable if the conditions for such exemption are satisfied. In Malaysia Real Property Gains Tax RPGT is one of the most important property-related taxes and is chargeable on the profit gained from selling a property. Income tax exemption on statutory income for 10 years from the provision of qualifying services to a person situated within designated nodes in the IDR or outside Malaysia.

Exemption from taxes imposed on purchases of hotel stays and other lodging including short-term property rentals and corporate housing arrangements in the United States on the basis of the diplomatic or consular status of the purchasing foreign mission or accredited mission member or dependent is authorized by the presentation of a valid diplomatic tax exemption. Describing it as a knee-jerk reaction he said. These include tax exemption for qualified CKD models with 100 exemption being given until 2022 75 exemption from 2023 to 2025 and 50 exemption from 2026 to 2030.

The DGC must then give effect to the exemption and there is no discretion as to whether such exemption will be granted regardless of any factors. This principle was applied in the Syarikat Pendidikan Staffield case. Operations must commence on or before 31 December 2020.

Most taxpayers are entitled to an exemption on their tax return that reduces your tax bill in the same way a deduction does. Bajet 2022 full speech pdf Parlimen Malaysia YouTube. Follow Loanstreet on Facebook Instagram for the latest updates.

KUALA LUMPUR Nov 1. Klik sini untuk versi BM. The proposed removal of tax exemption on incomes derived from foreign sources as announced under Budget 2022 should not be taken as a negative move that could discourage foreign.

I would like to encourage the team at the Finance Ministry to reconsider this particular point on the removal of the exemption on the foreign source. Theres also an exemption of 50 on the statutory income of rental received by Malaysian citizens who live in Malaysia. This can also be used and is required for tender applications and good standing in terms of foreign investment and for emigration purposes.

Under the single tier system income tax payable on the chargeable income of a company is a final tax in Malaysia. Veteran tax expert Dr Veerinderjeet Singh said he is surprised that the government has moved so fast to propose the removal of tax exemption for foreign sources of income. 603 2162 8990.

38-2019 containing the new guidelines for the processing and issuance of Certificates of Exemption CTE. Any dividends distributed by the company will be exempt from tax in. These cards facilitate the United States in honoring its host country obligations under the Vienna Convention on Diplomatic Relations VCDR.

Although the income is exempted from tax tax will have to be paid on the dividends paid on tax exempted income. KUALA LUMPUR Nov 9 The proposed removal of tax exemption on incomes derived from foreign sources as announced under Budget 2022 should not be taken as a negative move that could discourage foreign direct investments FDI said Finance Minister Tengku Datuk Seri Zafrul Abdul Aziz. This six month extension will apply to the 50 discount for CBU cars MPVs and SUVs as well he added.

Diplomatic Sales Tax Exemption Cards The Departments Office of Foreign Missions OFM issues diplomatic tax exemption cards to eligible foreign missions and their accredited members and dependents on the basis of international law and reciprocity.

Malaysia Sst Sales And Service Tax A Complete Guide

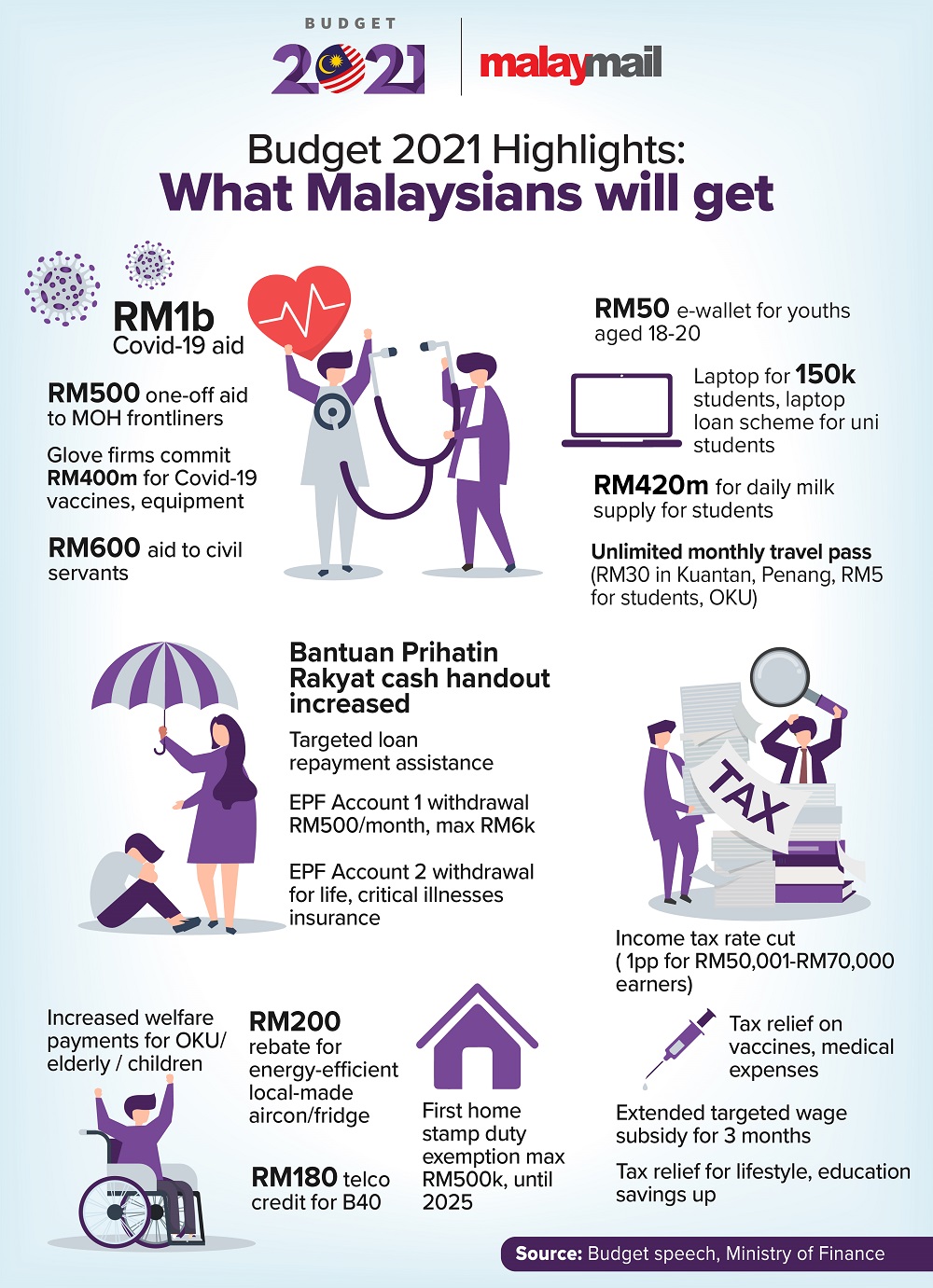

Budget 2021 Highlights Here S What Malaysians Can Expect To Get Directly Tax Breaks Handouts Subsidies And More Malaysia Malay Mail

Withholding Tax On Foreign Service Providers In Malaysia

Ncer Tax Incentives Ntax Ncer Northern Corridor Economic Region Ncer Malaysia

Everything You Should Claim For Income Tax Relief Malaysia 2021 Ya 2020

Business Income Tax Malaysia Deadlines For 2021

Calculate Your Chargeable Income For Income Tax Imoney

How Does The Green Investment Tax Allowance Gita Work Solarvest